Suppose that one day you decide to store all of your savings under the mattress. It would not have grown if you had forgotten about the money and left it alone for a year. The amount of money that you first placed there would be precisely the same.

In fact, in real terms, it would probably be worth less than when you put it there, because the cost of living is likely to have risen in the interim.

Imagine now that you had purchased commodities or shares, or other financial assets, with that money instead. Your money would have a far higher chance of growing rather than being ineffective, as the value of those shares or commodities might increase. However, there is always a chance that their value could also decline.

Trading the financial markets is all about balancing that risk with the potential reward and picking assets likely to move in your favor. As we will see, the benefits of doing this carefully and wisely may well exceed the costs of just leaving your money in a bank account (or under the mattress).

Trader vs. investor, which one are you?

What we’ve described is ‘investing,’ which is essentially a long-term form of financial trading that involves buying and holding financial assets over a number of months or years.

It’s quite likely that you’re already investing in the financial markets in some capacity possibly only passively. If you have a pension plan, for example, you’re investing the money you’re earning now with the expectation that it’ll grow and be worth more when you retire.

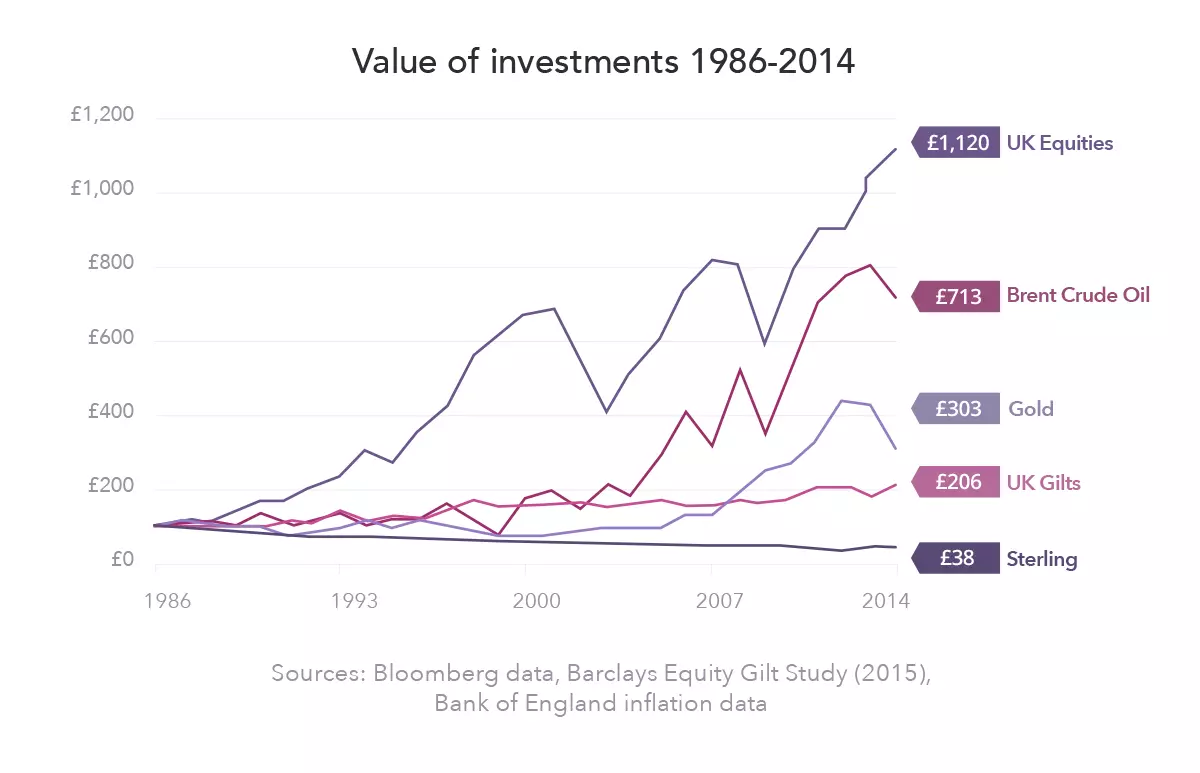

Pension firms generally invest this money in return for a management fee. In most cases, however, you can have a say in which financial instruments you put your money into. And as the chart below shows, a few simple decisions now could have a dramatic effect on the future.

Looking at the chart, you can see that £100 saved in cash in 1986 would be worth just £38 in 2014 due to inflation. If you’d invested that £100 in the UK stock market, you could have received a return of around £1120.

But long-term investing isn’t the only way of participating in the financial markets; there’s also active trading.

While investors generally focus on the long-term value of assets and attempt to build a portfolio that will perform well in the future, active traders tend to focus on short-term market movements, with some participants placing hundreds of trades per day.

Whether you choose to focus on the long term, making only a few trades per year, or whether you believe that every tiny movement in price represents an opportunity is entirely down to you, your personality, and how much time you can devote to trading.

We look at this topic in detail in the ‘Risk Management & Trading Strategy’ course, but for now, it’s important to note that there are many ways to trade and many different types of traders. And whatever your interests, skills, or priorities, there’s always a form of trading that will suit you.

One of the main differences between traders is the type of asset that they trade, and that’s what we’re going to start looking at in the next lesson…

Lesson summary

- Financial trading provides the potential for your money to grow, but there’s always the risk that you can lose money as well

- Investing focuses on the long-term value of assets

- Active trading focuses on shorter-term movements in price